2022 Irs Flexible Spending Account Limits - 2021 Fsa Commuter Benefits Contribution Limits Released Wex Inc

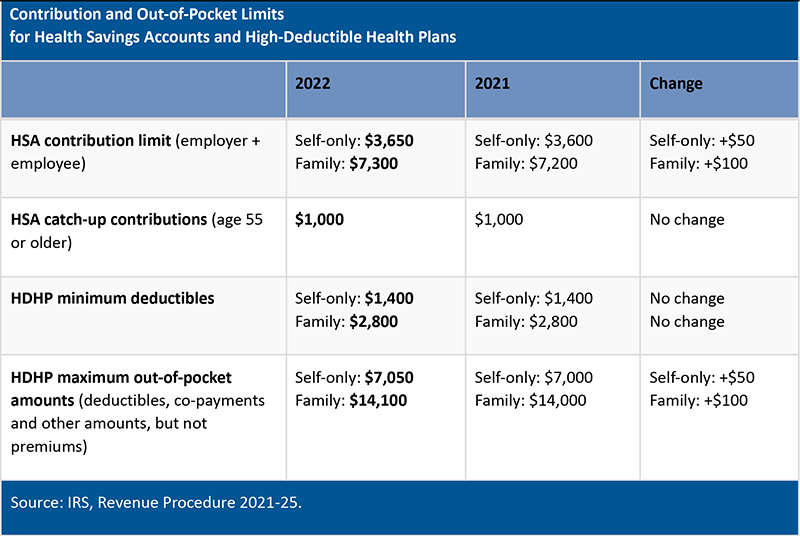

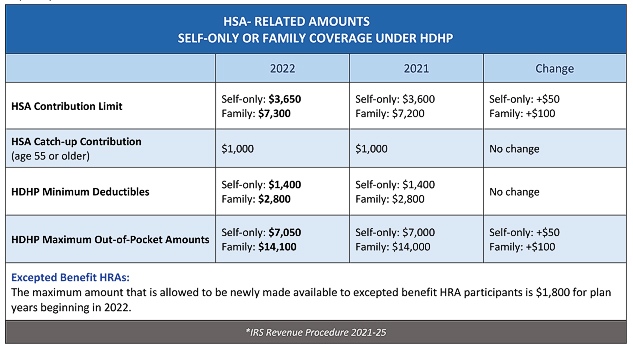

Family coverage is always double the single coverage so it will increase from 7200 to 7300. For calendar year 2022 the annual limit on deductions for an individual with family coverage under a high deductible health plan is 7300.

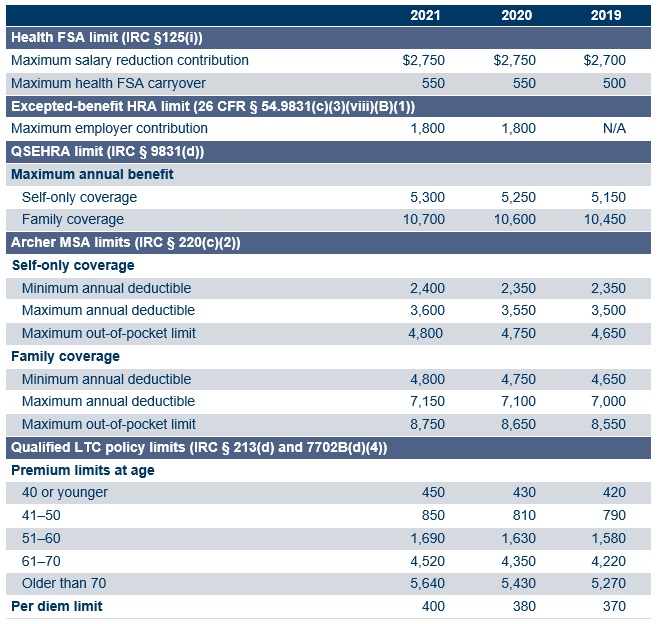

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

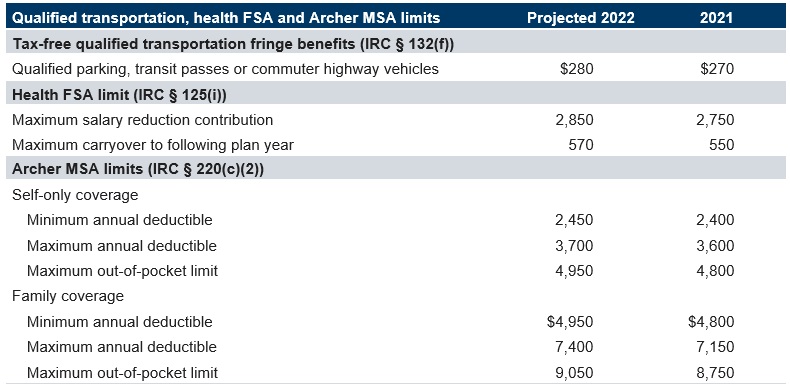

2022 transportation health FSA and Archer MSA limits projected.

2022 irs flexible spending account limits. 2022 Health Savings Account Limits LifeHealthyNet. Pre- tax Transit Parking Plans 27000 each per month. Flexible Spending Limited Flexible Spending 275000 max election per year.

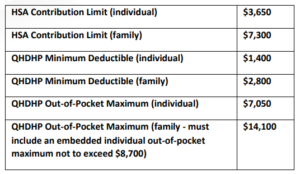

Increase in annual limit for Health Savings Account. IRS HSA Limits for 2022 - Flexible Benefit Administrators. 2022 HSA Maximum Contribution For calendar year 2022 the maximum HSA contribution is 365000 for a person enrolled as single and 730000 for a person enrolled as family.

Plan Out-of-Pocket Max for HSA Eligibility Family. Note that the DCFSA maximum increase to 10500 that was announced in July and adopted as a result of the American Rescue Plan Act of 2021 applies only to the 2021 plan year. Annual HSA Contribution Limit Family.

For calendar year 2022 the annual limitation on deductions for an individual with family coverage under a high deductible health plan is 7300. Special Rules for FSA Rollover for 2022 Due to the pandemic all unused FSA balances will automatically rollover from 2021 to 2022. Flexible Spending Accounts FSAs Health FSA Maximum Election.

This means that for the Healthcare account you may carry over 2750 into 2022. Plan Out-of-Pocket Max for HSA Eligibility Single. Dependent Care- 500000 max election per household per year.

Such as a general-purpose health flexible spending account certain prescription drug benefits etc. Annual HSA Contribution Limit Single. Health Flexible Spending Arrangements FSAs limitation.

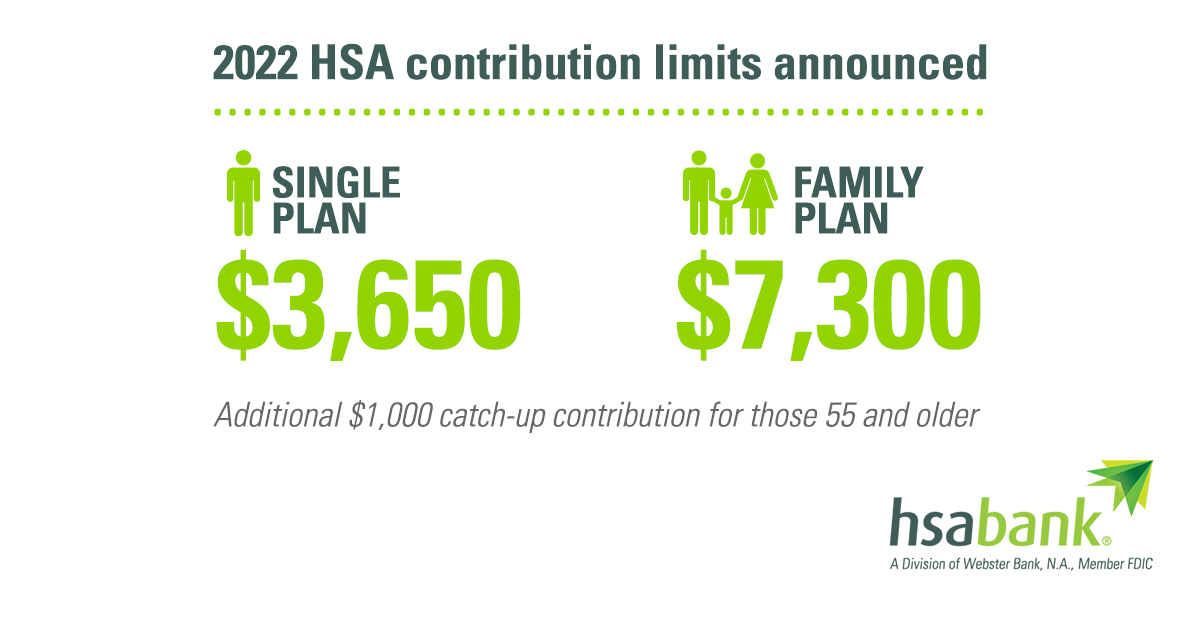

2022 Health Savings Account HSA Contribution Limits For single people the HSA contribution limit will increase from 3600 in 2021 to 3650 in 2022. 2022 Flexible Savings Account FSA Contribution Limits. You have to re-enroll in these benefits every year.

Salary reduction contributions to your health FSA for 2020 are limited to 2750 a year. Mercer projects the 2022 limits for qualified transportation parking and transit benefits health flexible spending arrangements FSAs and Archer medical savings accounts MSAs will increase. Ad Business-wide spending data in one place giving you the insights you need to grow.

2022 Maximum Amount for Excepted Benefit HRA. IRS HSA Limits for 2022. Trusted by thousands of companies.

The IRS announced the new limits for Health Savings Accounts HSAs are going up 50 for individual coverage and 100 for family coverage bringing them to 3650 and 7300 respectively. A Presidential Executive order created excepted benefit HRAs in. Employer contributions arent included in these limits.

Dependent Care Flexible Spending Account. The maximum annual HRA contribution is 1800 for plan years that begin in 2022. This inflation adjusted amount is listed in Revenue Procedure 2019-44 section 317 available at IRSgovpubirs-droprp-19-44.

If the new higher exclusion limit under ARPA is not extended by future legislation to apply to years after 2021 then the prior 5000 limit will apply again for 2022 2023 and future years. The amount of money employees could carry over to the next calendar year was limited to 550. These unofficial 2022 limits are determined using the Internal Revenue.

Dependent Care FSAs which previously allowed no carryover also have an unlimited carryover provision in. The IRS has announced 2022 pre-tax limits for the following programs. Dependent Care FSA Maximum Election.

Health savings account HSA contribution limits for 2022 are going up 50 for self-only coverage and 100 for family coverage the IRS announced giving. Minimum annual HDHP deductible Single. The IRS has announced the annual cost-of-living adjustments for health savings account contributions for calendar year 2022.

The catch-up contribution limit for those over. Waiting on IRS to announce annual limit for Flexible Spending. 1000 if over age of 55.

7 hours ago The IRS announced the new limits for Health Savings Accounts HSAs are going up 50 for individual coverage and 100 for family coverage bringing them to 3650 and 7300 respectively. If you are age 50 or over the catch-up contribution limit will stay the same at 3000 in 2022 as in 2021. The contribution limit for SIMPLE 401k and SIMPLE IRA plans will go up from 13500 in 2021 to 14000 in 2022.

In Revenue Procedure 2021-25 the IRS says that for calendar year 2022 the annual limitation on deductions for an individual with self-only coverage under a high deductible health plan is 3650. Just Now IRS HSA Limits for 2022 Flexible Benefit Administrators. Catch-up contributions of 1000 can be made during the year by HSA.

Minimum annual HDHP deductible Family. Automate your expenses save time money and mistakes. Dependent Care Flexible Spending Account DCFSA limits For 2022 employees may contribute pre-tax up to 5000 in dependent care FSA accounts.

Employers may allow participants to carry over unused amounts IR-2021-40 February 18 2021 WASHINGTON The Internal Revenue Service today provided greater flexibility due to the pandemic to employee benefit plans offering health flexible spending arrangements FSAs or dependent care assistance programs. However the Act allows unlimited funds to be carried over from plan year 2021 to 2022. Ad Business-wide spending data in one place giving you the insights you need to grow.

By Brandee May 12 2021 IRS Update News Updates 0 comments. 2021-25 also includes the 2022 revised annual contribution limit for excepted benefit HRAs. 3650 for employee-only coverage 7300 for all other coverage levels.

HSA limits 2022. There is no limit on the rollover amount for either Healthcare or Dependent care. Trusted by thousands of companies.

Spending Accounts do not roll over to the next year. Automate your expenses save time money and mistakes.

2021 Fsa Commuter Benefits Contribution Limits Released Wex Inc

Fsa Rules 3 Tips For Easily Complying With The Irs Connectyourcare

Irs Releases Hsa Contribution Limits For 2022 Primepay

What The New Hsa Limits For 2022 Means For You The Difference Card

![]()

2022 Hsa Limits Cost Of Living Adjustments Released By Irs Basic

Irs Announces 2022 Limits For Hsas And High Deductible Health Plans

Upmc Irs Announces Hsa Fsa And Hdhp Contribution And Oop Limits For 2020 Neishloss Fleming

Hsa Bank On Twitter Take Your Hsa To The Max The Irs Increased Contribution Limits Starting In 2022 You Can Contribute 3 650 To Your Hsa For Single Coverage Or 7 300 For Family

Irs Announces 2022 Limits For Hsas And High Deductible Health Plans

Sterling Administration 2022 Hsa And Hdhp Limits Claremont Insurance Services

Hsa Administrators Advisory Group Inc

Irs Announces 2022 Health Savings Account Limits As Hsa Assets Soar

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Recent Irs Notices Benefit Minute Psa Insurance Financial Services

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

Irs Releases Hsa Contribution Limits For 2022 Primepay

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance